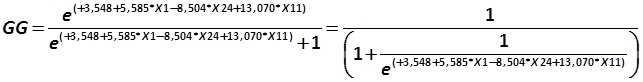

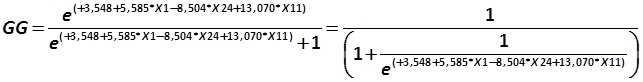

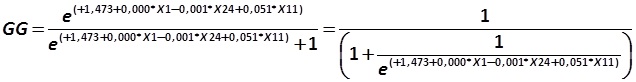

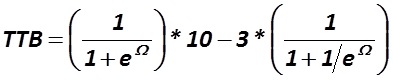

Gloubos-Grammaticos model (1988, Greece) Gloubos-Grammaticos

3-77.jpg:643x82, 16k

|

|

|

Gloubos-Grammaticos model (1988, Greece) Gloubos-Grammaticos 3-77.jpg:643x82, 16k |

|

The "old new" method of E. Altman in 1968, the United States E. Altman, Ghent University 319.jpg:589x30, 12k |

|

X1 – is the ratio of NWC: Net working capital (current assets minus current liabilities) to total assets (TAS) E. Altman, Ghent University 320.jpg:170x32, 3k |

|

X2 – the ratio (amount of profit / loss during the reporting period (P/L) and retained earnings of previous years (REPY)) to total assets (TAS) E. Altman, Ghent University 321.jpg:282x35, 6k |

|

X3 – a measure of profitability. E. Altman, Ghent University 322.jpg:373x43, 8k |

|

X4 – a ratio of the cost of equity capital (OC(Eq)) to total liabilities (TL) E. Altman, Ghent University 323.jpg:228x43, 5k |

|

X5 – is the ratio of revenue (Rev) to total assets (TAS) E. Altman, Ghent University 324.jpg:201x40, 4k |

|

The "old new" method of E. Altman in 1968, the United States E. Altman, Ghent University 325.jpg:584x30, 12k |

|

The "old new" method of E. Altman in 1968, the United States E. Altman, Ghent University 326.jpg:589x30, 12k |

|

The new method of E. Altman with re-estimated by Ghent University constants and ratios E. Altman, Ghent University 327.jpg:618x30, 12k |

|

The new method of E. Altman with re-estimated by Ghent University constants and ratios E. Altman, Ghent University 328.jpg:626x30, 12k |

|

The new method of E. Altman with re-estimated by Ghent University constants and ratios E. Altman, Ghent University 329.jpg:617x30, 12k |

|

The "old new" Bilderbeek model J. Bilderbeek, Ghent University 330.jpg:577x28, 11k |

|

X6 – a net gain or net profit / NP / (after tax) in relation to equity capital (OC(Eq)) J. Bilderbeek, Ghent University 331.jpg:217x39, 5k |

|

X7 – the ratio of accounts payable (AP) to revenue (Rev) J. Bilderbeek, Ghent University 332.jpg:222x46, 5k |

|

X8 – the ratio of gross value added (GVA) in total assets (TAS). J. Bilderbeek, Ghent University 333.jpg:180x35, 4k |

|

X2 – the calculation of this indicator is shown in a model of Altman E. Altman, Ghent University 334.jpg:284x36, 5k |

|

The "old new" Bilderbeek model J. Bilderbeek, Ghent University 335.jpg:582x25, 11k |

|

The "old new" Bilderbeek model J. Bilderbeek, Ghent University 336.jpg:574x25, 9k |

|

The new Bilderbeek model with re-estimated by Ghent University ratios and constants J. Bilderbeek, Ghent University 337.jpg:641x25, 10k |

|

The new Bilderbeek model with re-estimated by Ghent University ratios and constants J. Bilderbeek, Ghent University 338.jpg:641x25, 12k |

|

The new Bilderbeek model with re-estimated by Ghent University ratios and constants J. Bilderbeek, Ghent University 339.jpg:641x28, 12k |

|

The "old new" Ooghe-Verbaere model in the Ooghe-Balcaen model Eric Verbaere, Ghent University 340.jpg:659x22, 10k |

|

X9 – is the amount of late /overdue/ payment of taxes (LPT) and the outstanding payments to social contributions (OPSC) with respect to short-term liabilities (STL). Eric Verbaere, Ghent University 341.jpg:275x37, 5k |

|

X16 – a ratio of profit / loss after tax (NP) and retained earnings (RetY) of the past to the sum of equity capital (OC(Eq)) and liabilities (TL) Eric Verbaere, Ghent University 342.jpg:348x34, 7k |

|

X13 – is the ratio of cash (MF) and direct cash equivalents / short-term investments (STI) / (MF + STI) to the sum of current / mobile / assets (MobA). Eric Verbaere, Ghent University 343.jpg:332x42, 7k |

|

X14 – the ratio of the cost of: production in progress (PPC), finished goods and goods for resale (FG&GR) and goods shipped and dispatched (SDG) to the sum of net working capital (NWC = MobA – STL) Eric Verbaere, Ghent University 344.jpg:639x28, 13k |

|

X17 – a measure of the total return on permanent capital. Eric Verbaere, Ghent University 345.jpg:364x28, 7k |

|

X10 – The ratio of total profit or loss (NP) to the sum of equity capital (OC(Eq)) and liabilities (TL) Eric Verbaere, Ghent University 346.jpg:309x40, 6k |

|

The "old new" Ooghe-Verbaere model in the Ooghe-Balcaen model Eric Verbaere, Ghent University 346a.jpg:656x23, 10k |

|

X15 – the ratio of cash flow (CF) to revenue (Rev). Eric Verbaere, Ghent University 347.jpg:215x43, 4k |

|

The "old new" Ooghe-Verbaere model in the Ooghe-Balcaen model Eric Verbaere, Ghent University 348.jpg:664x23, 13k |

|

X11 – Gross yield (GY) before taxes in relation to total assets (TAS). Eric Verbaere, Ghent University 348a.jpg:195x39, 4k |

|

X12 – the ratio of equity capital (OC(Eq)) to the sum of equity capital (OC(Eq)) and total liabilities (TL) Eric Verbaere, Ghent University 349.jpg:313x35, 7k |

|

A new Ooghe-Verbaere technique Eric Verbaere, Ghent University 350.jpg:594x23, 9k |

|

A new Ooghe-Verbaere technique Eric Verbaere, Ghent University 351.jpg:594x23, 9k |

|

A new Ooghe-Verbaere technique Eric Verbaere, Ghent University 352.jpg:594x23, 9k |

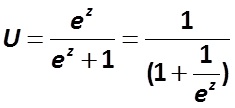

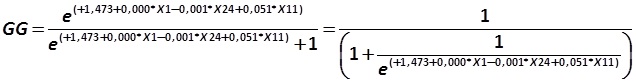

LOGIT regression 353.jpg:235x108, 6k |

|

LOGIT regression 354.jpg:380x26, 6k |

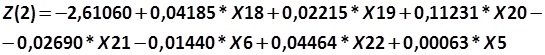

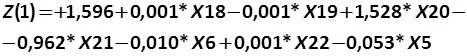

The "old new" Christine Zavgren model in the Ooghe-Balcaen model Christine Zavgren, Ghent University 355.jpg:541x55, 19k |

|

X18 – is the ratio of inventories (Inv) to the sum of the company's revenues (Rev): Christine Zavgren, Ghent University 356.jpg:210x41, 4k |

|

X19 – is the ratio of accounts receivable (AR) to inventories (Inv) Christine Zavgren, Ghent University 357.jpg:218x44, 4k |

|

X20 – is the sum of money (MF) and short-term investments (STI) to company’s book value (TAS) Christine Zavgren, Ghent University 358.jpg:289x44, 6k |

|

X21 coefficient is a measure of instant liquidity of the company. Christine Zavgren, Ghent University 359.jpg:397x35, 8k |

|

X6 – a net gain (after tax) / NP / in relation to equity capital (OC(Eq)) Christine Zavgren, Ghent University 360.jpg:195x35, 4k |

|

X5 – is the ratio of earnings (Rev) to total assets (TAS) Christine Zavgren, Ghent University 361.jpg:169x34, 3k |

|

X22 – a measure, the numerator of which is the amount of deferred income (DefIn), and accrued obligations (AcrO). Christine Zavgren, Ghent University 362.jpg:505x31, 11k |

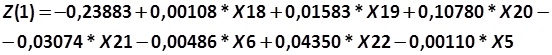

The "old new" Christine Zavgren model in the Ooghe-Balcaen model Christine Zavgren, Ghent University 363.jpg:545x55, 21k |

The "old new" Christine Zavgren model in the Ooghe-Balcaen model Christine Zavgren, Ghent University 364.jpg:552x55, 19k |

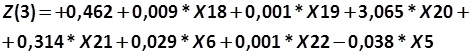

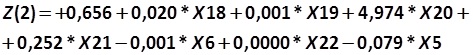

A new method of Christine Zavgren Christine Zavgren, Ghent University 365.jpg:473x55, 16k |

A new method of Christine Zavgren Christine Zavgren, Ghent University 366.jpg:473x55, 18k |

A new method of Christine Zavgren Christine Zavgren, Ghent University 367.jpg:467x56, 18k |

|

Gloubos-Grammaticos model (1988, Greece) Gloubos-Grammaticos 368.jpg:668x25, 13k |

|

X23 – this is the current liquidity ratio. In simple term, it is the sum of current assets (MobA) in relation to short-term liabilities (STL) Gloubos-Grammaticos 369.jpg:216x36, 4k |

|

X24 – is the ratio of long-term liabilities (LTL) to total assets (TAS) Gloubos-Grammaticos 370.jpg:201x39, 4k |

|

X25 – a relationship of EBITDA to total current liabilities. Gloubos-Grammaticos 371.jpg:478x31, 9k |

|

Gloubos-Grammaticos model (1988, Greece) Gloubos-Grammaticos 372.jpg:667x25, 13k |

|

Gloubos-Grammaticos model (1988, Greece) Gloubos-Grammaticos 373.jpg:668x25, 13k |

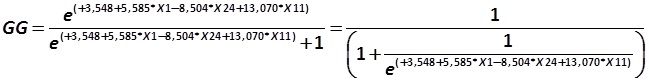

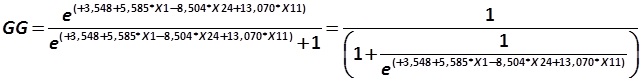

Gloubos-Grammaticos model (1988, Greece) Gloubos-Grammaticos 374.jpg:649x82, 16k |

|

Gloubos-Grammaticos model (1988, Greece) Gloubos-Grammaticos 375.jpg:462x30, 8k |

Gloubos-Grammaticos model (1988, Greece) Gloubos-Grammaticos 376.jpg:643x82, 16k |

Model of the crisis of the investment cycle: 3 years prior to bankruptcy Gloubos-Grammaticos, Ghent University 377.jpg:643x82, 16k |

|

A new Gloubos-Grammaticos model (GG) with re-estimated ratios and constants Gloubos-Grammaticos, Ghent University 378.jpg:668x25, 13k |

|

A new Gloubos-Grammaticos model (GG) with re-estimated ratios and constants Gloubos-Grammaticos, Ghent University 379.jpg:668x25, 13k |

|

A new Gloubos-Grammaticos model (GG) with re-estimated ratios and constants Gloubos-Grammaticos, Ghent University 380.jpg:673x28, 13k |

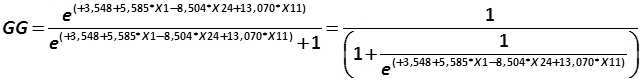

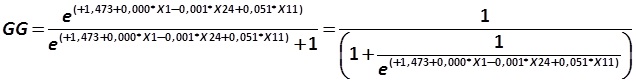

A new Gloubos-Grammaticos model (GG) with re-estimated ratios and constants Gloubos-Grammaticos, Ghent University 390.jpg:636x82, 17k |

|

A new Gloubos-Grammaticos model (GG) with re-estimated ratios and constants Gloubos-Grammaticos, Ghent University 391.jpg:476x33, 7k |

A new Gloubos-Grammaticos model (GG) with re-estimated ratios and constants Gloubos-Grammaticos, Ghent University 392.jpg:636x82, 17k |

A new Gloubos-Grammaticos model (GG) with re-estimated ratios and constants Gloubos-Grammaticos, Ghent University 393.jpg:636x82, 17k |

Model of K. Keasey and P. McGuinness (1990, 2009, UK) K. Keasey and P. McGuinness, Ghent University 394.jpg:229x93, 6k |

|

Model of K. Keasey and P. McGuinness (1990, 2009, UK) K. Keasey and P. McGuinness, Ghent University 395.jpg:604x28, 13k |

|

Model of K. Keasey and P. McGuinness (1990, 2009, UK) K. Keasey and P. McGuinness, Ghent University 395a.jpg:680x34, 8k |

|

X26 – a relationship of raw materials and similar values (RM) to the amount payable (AP) K. Keasey and P. McGuinness, Ghent University 396.jpg:198x39, 4k |

|

X27 – the ratio of operating profit (PBT) to the amount of revenue (Rev) K. Keasey and P. McGuinness, Ghent University 397.jpg:225x41, 4k |

|

Model of K. Keasey and P. McGuinness (1990, 2009, UK) K. Keasey and P. McGuinness, Ghent University 398.jpg:609x25, 12k |

|

X18 – is the ratio of inventories (Inv) to the sum of the company's revenues (Rev) K. Keasey and P. McGuinness, Ghent University 399.jpg:229x44, 4k |

|

X28 – the ratio of net profit (NP) to the sum of operating assets (OPA). K. Keasey and P. McGuinness, Ghent University 400.jpg:216x41, 4k |

|

Model of K. Keasey and P. McGuinness (1990, 2009, UK) K. Keasey and P. McGuinness, Ghent University 401.jpg:488x28, 10k |

|

Model of K. Keasey and P. McGuinness (1990, 2009, UK) K. Keasey and P. McGuinness, Ghent University 401a.jpg:537x30, 7k |

|

A new Keasey-McGuinness model with re-estimated ratios and constants K. Keasey and P. McGuinness, Ghent University 402.jpg:560x25, 11k |

|

A new Keasey-McGuinness model with re-estimated ratios and constants K. Keasey and P. McGuinness, Ghent University 403.jpg:548x25, 11k |

|

A new Keasey-McGuinness model with re-estimated ratios and constants K. Keasey and P. McGuinness, Ghent University 404.jpg:457x25, 9k |

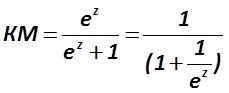

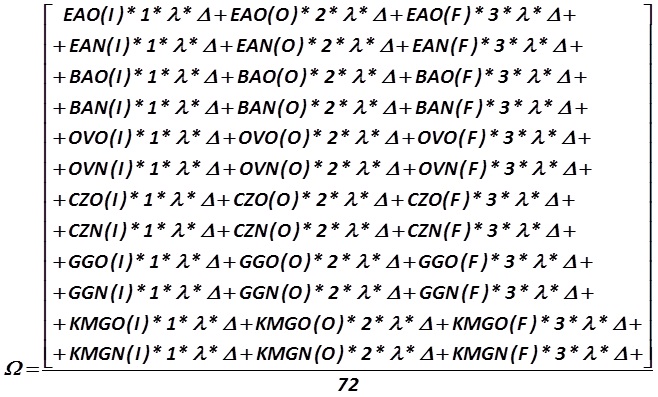

Author's method of Alexander Shemetev for calculating the probability of failure and term prior to the bankruptcy, based on Ghent University studies Alexander Shemetev 405.jpg:393x82, 10k |

Author's method of Alexander Shemetev for calculating the probability of failure and term prior to the bankruptcy, based on Ghent University studies Alexander Shemetev 406.jpg:658x397, 121k |

Alexander Shemetev's photo Alexander Shemetev alexshemetev300dpi.jpg:300x301, 63k |

Sofie (Sofia) Balcaen's photo Sofie (Sofia) Balcaen balcaens.jpg:189x222, 14k |

Hubert Ooghe's photos Hubert Ooghe oogheh.jpg:157x245, 12k |

Eric Verbaere's photo Eric Verbaere verbaeree.jpg:208x313, 20k |